The combination of fashion and sportswear is the current trend in the sportswear market. The sportswear market consists of 2 segments: sportswear and sports footwear. The global sportswear market has great potential thanks to rapid innovation and growing health awareness among the population. The explanation for this market's growth stems from the increase in spending per capita on sportswear, the growing popularity of outdoor recreation, and the number of people joining yoga and growing fitness club membership, with the rise in e-commerce has increased the online penetration of sportswear products around the world.

Figure 1: Increasing awareness of healthy lifestyles and a growing tendency to approach sports and fitness have helped drive the market.

The global sportswear market tends to innovate, raising awareness about health, the popularity of sports, the combination of smart clothing and the development of functional clothing. However, market growth will be hampered by the availability of counterfeit goods, increased labor costs and the ability to negotiate lower prices from buyers.

Sports clothing market overview

Increasing awareness of healthy lifestyles and an increasing trend toward sport and fitness, as well as athletic activities such as the World Cup, Olympic Games and World cricket have helped to promote sports clothing market.

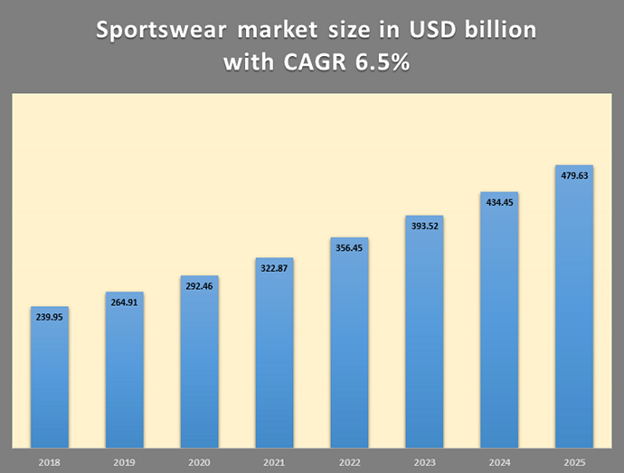

Industry results reached around 239.95 billion USD in 2018 and expected to achieve a CAGR of 10.4% between 2019 and 2025. The total sportswear market is expected to reach 479 billion dollars worldwide by 2025.

As a general low-growth apparel and footwear segment, athletic wear has grown in importance over time. Sportswear has grown from around 18% in the apparel sector in 2007 to around 26% in 2019.

Figure 2: Sports apparel market size in billion USD with a CAGR of 6.5%. (Source Statista).

The sportswear market has shown a compound annual growth rate (CAGR) of 6.5% over the past five years, one and a half times that of the apparel market.

North America is the largest sportswear market in the world, with more than 30% market share and market size, the US market is estimated at about 62 billion USD and is expected to grow at a CAGR of 3. , 1% within the next 5 years. However, demand for sports equipment in Europe grew more rapidly than in North America and Asia Pacific. The European sportswear industry is currently estimated at $ 115,709 million and $ 172,315 million by 2025. Furthermore, experts predict a CAGR of 5.5% from 2018 to year. 2025.

Asia Pacific's market share is also increasing significantly due to the growing population and increasing disposable income of customers.

Figure 3: A growing awareness of healthy lifestyles and a growing trend toward sports and fitness are helping this segment to grow.

Market segmentation

The global sportswear market can be subdivided based on product, end use, distribution channel and geographic region. In terms of products, the market can be divided into sportswear, sports shoes and others.

The market can be classified into men's, women's, and children's clothing based on the target audience. Men's apparel accounts for a large share of the global sportswear market. However, women's outfits are expected to expand significantly in the near future.

Depending on distribution channels, the global sportswear market can be divided into online and offline channels.

Geographically, the global sportswear market can be divided into North America, Europe, Asia Pacific, the Middle East, Africa and South America. Due to the application of many new and advanced technologies, North America occupies a large market share in the market in the coming period. The Asia-Pacific region is likely to see significant growth due to increased consumer incomes.

Outstanding sports clothing products

Clothing and footwear are the two product segments that drive both sportswear sales and overall market growth.

Sports shoes are classified into tennis shoes, soccer shoes, and basketball shoes. The industry also sees a trend in brands using high-tech technology to make footwear.

Clothing segment including Jerseys, tri-hole pants, sneakers, sweatshirts, jackets, hoodie, jogger pants, shorts, sports bras, leggings, etc. also play an important role in increasing sports apparel industry sales. This segment is expected to have the highest CAGR of 10.7% from 2019 and through 2025.

The growth of brands

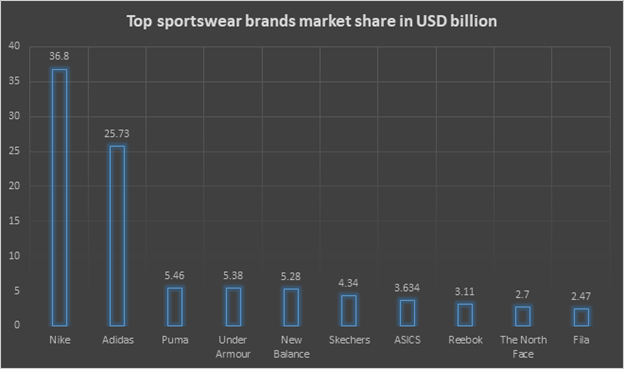

Figure 4: Financial chart of famous sportswear brands in 2018 in billion euros (Source: Statista)

In 2018, Nike holds 41% of the world market share, with sales of $ 36.80 billion, while Adidas, Puma, Under Armor have a market share of 22%, 10%, 9%, and $ 25.73 billion, respectively. , 6.63 billion USD, 5.38 billion USD. Nike has 45% and 18% of its revenue coming from North America and Western Europe, while Adidas has 29% and 21% from North America and Western Europe.

Sports wear during the Covid-19 outbreak

Despite the challenges, sportswear still appears to be a good resilience category to COVID-19. In the midst of a pandemic outbreak, as consumers' desires for their health and well-being increase, sportswear has a good development advantage as consumers tend to adopt style. live an active life.

Sportswear seems to be crowned after COVID-19. Sportswear brands connect with customers and launch their business through more profitable channels.

Over the past few years, sportswear companies have been actively adopting digital technology into their DNA. The ability to chat face-to-face with buyers, expand messaging functionality and boost engagement allows for faster online sales during downtime.

Investment Opportunities

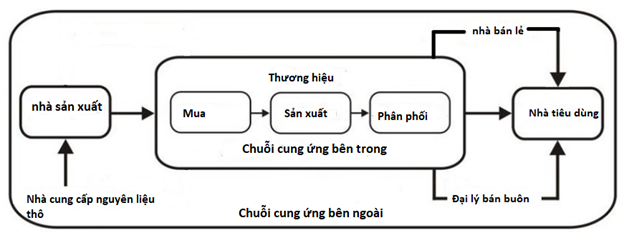

By researching the sportswear use market from manufacturers to retailers, different brands in the supply chain can capture significant information, even though the brands are in a leading position.

Bangladesh 's potential for growth in the sportswear industry Despite being the world's second-largest apparel exporter after China, Bangladesh accounts for only a small share of the global sportswear market. Bangladesh is stepping up striving to reach 50 billion USD by 2021 but is lagging far behind with 35 billion USD.

Quality products at cheaper prices will attract the most buyers. Sports clothing brands such as Decathlon, Puma and Adidas have entered the Bangladesh market. Sports clothing brands like Hummel, Fila, Columbia sportswear, Under Armor are also buying from Bangladesh. Not only Jersey, Bangladesh also offers a wide variety of high-end sports and athletic apparel for many famous football, cricket, badminton, golf clubs in the United States, EU and other countries.

However, according to the EPB, in 2018, the export value of sportswear only accounted for 10% of the total export value of 32.92 billion USD and accounted for a negligible proportion in the global market. Therefore, it can be said that Bangladesh has huge potential in the global sportswear market.

https://vinatex.com.vn/thoi-trang-the-thao-co-hoi-dau-tu-trong-boi-canh-moi/

Source: vinatex.com.vn