Unable to operate at full capacity, increasing logistics costs, labor shortages, rising labor costs... are the challenges that the textile and garment industry will face in the last months of 2021.

Some textile and garment enterprises have announced their business results for July 2021 with unsatisfactory business results, reflecting the negative impacts of the 4th wave of COVID-19 epidemic.

TNG Investment and Trade (code TNG) also said that the shortage of containers has affected major overseas fashion brands, making it difficult to charter ships, affecting TNG's delivery activities and monthly revenue and profit. 7 also dropped.

According to the recently published report on the textile and garment industry of VNDIRECT, this securities company assessed that the COVID-19 outbreak in the southern region could disrupt the supply chain again as companies could not transport goods. material transfer and lack of human resources to ensure delivery time.

According to the Vietnam Textile and Apparel Association (VITAS), the prolonged social distancing period will greatly affect the business results of textile and garment companies when about 50% of factories are located in the southern region. Currently, the rate of factories having to close has reached 30-35%, mainly small and medium enterprises due to insufficient funds to implement "3 on-site" for employees.

According to VITAS, Vietnam's textile and garment industry is facing challenges due to labor shortages and low vaccination rates for the textile and garment industry. With the positive scenario that COVID-19 is under control by the end of August 2021, the export turnover of Vietnam's textile and garment in 2021 may only reach 33 billion USD, down 6% over the same period, completing 84%. Vietnam Government's plan for 2021 ($39 billion).

According to VNDIRECT, high logistics costs are an obstacle for Vietnam's textile and garment industry. Specifically, the cost of shipping by containers has tripled in the first 6 months of 2021. “The shortage of empty containers and rising logistics costs may affect businesses with ODM and OBM orders. Furthermore, VITAS forecasts that if the COVID-19 epidemic is brought under control by the end of August 2021, the number of workers is expected to reach only 60-65%. Therefore, the shortage of human resources will also challenge the textile and garment industry in the third quarter of 2021.

Vietnam has the opportunity to win the market from competitors

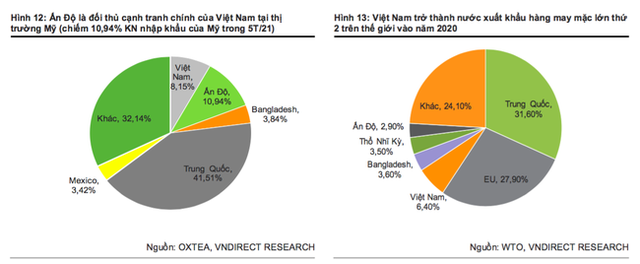

Not only Vietnam, many countries are facing a wave of COVID-19 epidemic, causing factories in India and Myanmar to close or operate at 50% capacity.

Indian textile and garment exporters are facing the risk of losing most of their orders to rivals such as Vietnam, Bangladesh, Sri Lanka and Pakistan. Many Indian garment factories have to close or operate at only 50% capacity to prevent new COVID-19 infections. According to Economic Times, Indian textile businesses in Tamil Nadu and Karnataka are worried that their orders will halve in the second half of the year because they cannot send samples to fashion brands to prepare their collections. new episode.

Myanmar's textile and garment industry is facing two major problems at the same time: the increasing number of COVID-19 infections and the unstable political situation since March 2021. In the first half of 2021, the number of workers employed in Myanmar textile companies is estimated to decrease by 31% year-on-year due to factory closures.

“Although Vietnam is facing the 4th outbreak of COVID-19 epidemic, we expect that the negative impacts from the political situation and the epidemic on Myanmar and India are an opportunity for Vietnam. Nam increased market share in the US and South Korea”, the report of VNDIRECT said.

VNDIRECT believes that TNG, MSH and GIL can be the most beneficial businesses because their factories are located in Thai Nguyen, Nam Dinh and Hue, which are outside the current epidemic epicenter. It is estimated by VNDIRECT that supply disruptions in India and Myanmar will contribute 20% and 15% to TNG and MSH's revenue in 2021, respectively.

Regarding stock options, according to VNDIRECT, increasing global demand for recycled yarn will be the main driver of STK's revenue growth in 2021-2023. In addition, the company applies Spinning chip technology that makes it easy to switch between virgin and recycled fibers.

STK will expand capacity to 99,000 tons/year in 2023 and 123,000 tons/year in 2025 to meet growing demand from recycled and high-grade virgin fibers.

VNDIRECT expects STK to expand its market share in the US market thanks to the low preliminary anti-dumping duty imposed by the US Department of Commerce from May 26, 2021. STK 2021's net profit is expected to grow 103.4 percent year-on-year and achieve a compound growth rate of 26.3% in 2021-2023.

According to Bao Vy

https://cafef.vn/det-may-doi-dien-voi-song-gio-20210819143225192.chn

cafef